Breaking the $3M Growth Plateau: The Founder-Led Sales Bottleneck

Executive Summary

- Growth Stalls at the First Bottleneck: Many bootstrapped, founder-led businesses in the $1–5 million revenue range experience a plateau around low seven figures – often stalling at roughly $3M when the founder remains the sole sales closer . This plateau is not due to market saturation or delivery capacity, but because sales become the binding constraint on growth. The founder’s personal bandwidth for closing deals becomes a hard ceiling on revenue, creating a growth bottleneck.

- Founder-Only Sales = Capacity Cap: In early stages, founders drive sales through hustle and personal networks, which can rapidly take a company to its first $1M or $3M in revenue. But what sparks initial growth later becomes the chokepoint. With the founder managing most or all sales, new business generation maxes out at the founder’s available time and energy, causing revenue to flatline despite strong demand or product development . Other areas (delivery, operations, marketing) might be well-positioned to scale, but they’re underutilized because sales throughput is stuck at a trickle.

- Evidence of the Sales Bottleneck: A consistent pattern observed in small agencies and B2B firms is flat or slowing growth once they hit the low millions in revenue, coinciding with the limits of founder-led selling. For example, agencies relying mainly on referrals often plateau near ~$1M ARR; one founder saw 80% of pipeline come from word-of-mouth – “growth was ‘easy’ until it wasn’t.” When referrals slowed, leads went stale and revenue flatlined . Similarly, consultancies report a common plateau around $3–5M when their initial relational selling tactics max out . These real-world cases underscore that depending on the founder as the chief (or only) rainmaker eventually stalls the business’s top-line.

- Hidden Constraints Remain Hidden: Crucially, this founder-sales bottleneck masks other growth constraints. Because the company isn’t closing significantly more deals, it never fully tests the limits of delivery capacity, operational systems, or marketing reach. In effect, sales is the “first domino” – until it’s fixed, no other constraint truly binds the business. Founders often don’t realize that issues like service capacity or team scalability could become problems, because they’re never pushed to that scale. Only by relieving the sales bottleneck can the organization grow enough to encounter and address the next set of challenges.

- Impact: Missed Revenue and Founder Burnout: The opportunity cost of an unaddressed sales bottleneck is substantial. High-potential leads go cold for lack of follow-up, and each month without added sales capacity can mean tens of thousands in forgone bookings. One analysis showed that a founder spending 30 hours/week on sales (closing ~$15K in new ARR monthly) instead of hiring/partnering to close $30K could be “leaving $60K+ in growth on the table every quarter” – over $240K in annual revenue lost to the bottleneck. Furthermore, founders stretched thin by perpetual selling face rising stress and burnout. A 2023 survey found 72% of founders report that entrepreneurship has harmed their mental health , with burnout often attributed to shouldering sales on top of all other roles. In short, founder-led sales at scale not only constrains revenue but also exacts a personal toll, threatening the sustainability of the business’s leadership.

(This report focuses on diagnosing and validating the founder-led sales bottleneck as the primary growth barrier. It does not cover solutions or remedies, which would be addressed separately.)

The Founder-Led Sales Bottleneck: Why Growth Stalls

In most young companies, the founder initially is the sales engine. Early revenue is often powered by the founder’s hustle, industry contacts, and personal touch in deals. This “founder-led sales” phase is often necessary and even beneficial at first – the founder’s passion and knowledge help win the first clients. However, as the business grows into the seven-figure range, that same model transforms into a liability. The founder’s time and attention become a finite resource that constrains further expansion. As one industry veteran bluntly notes, “if you as the CEO are the bottleneck, you are limiting the capacity of the entire organization” – the company can only grow at the pace of your personal output .

Several telltale signs signal when founder-led sales has become a growth ceiling :

- Revenue Plateaus Despite Demand: The business is still seeing market interest and product/service improvements, but sales aren’t keeping up. Internal teams notice that revenue flatlines for months on end, even though new leads come in. This is a classic symptom of a sales capacity bottleneck – there are opportunities to grow, but the founder simply cannot pursue or close them all. A venture analysis describes this moment: “the numbers tell the story…something has to change” when pipelines dry up and the founder is stretched too thin . In short, the business stops growing not because of lack of opportunity, but because the sales function (personified by the founder) is maxed out.

- Lead Follow-Up Falls Behind: The founder starts dropping balls with leads. Warm inquiries that would have been jumped on in days now languish for weeks. As one experienced founder admitted, “good leads from yesterday are going stale today, because you don’t have time to pay attention to them” . The sales CRM, if one exists, is incomplete or out-of-date because the busy founder can’t log every detail . Follow-ups become inconsistent, leading to missed chances. This leakage is often invisible at first – deals don’t actively “break,” they just quietly never close. Over time, though, the cumulative effect is large: an expert observed some startups “lose nearly half of their pipeline to fallout” simply from inadequate follow-up and qualification, a direct result of sales bandwidth overload .

- Founder’s Bandwidth Is Exhausted: Perhaps the clearest indicator is the founder’s own schedule. The CEO finds themselves spending the majority of their week in sales calls, demos, and pitches, leaving little time for anything else. In the words of one SaaS founder, “You spend 80% of your week on sales – because ‘it’s working’ – while ignoring [other vital areas]… You’ve become your own bottleneck.” . It’s not uncommon for founders in this stage to report 20–30 hours per week dedicated to sales activities – effectively a full-time job on top of running the company. This is a double hit: it limits sales growth (one person can close only so much), and it starves other parts of the business of leadership attention. Strategy, product development, team management, and innovation all take a backseat, which can sow the seeds for stagnation in those areas as well.

- Stalling at a Common Inflection Point: Founder-led firms often hit a predictable revenue wall. While the exact number varies by industry, many professional services and software businesses report a stall around the low millions in annual revenue if the sales model isn’t expanded beyond the founder. For some agencies, this happens near $1M–$2M ARR if they rely heavily on personal referrals . For others, it’s around $3M–$5M – a point at which the business has maybe a dozen employees and a solid delivery team, but new client acquisition slows to a crawl. McKinsey and other analysts have noted that companies often “stall at ~$3M…and those that [in contrast] sail past $10M” have done so by evolving their sales approach and infrastructure . In essence, the first major growth inflection point for a founder-led company typically arrives when the founder’s capacity to sell is fully utilized. Without a change, the company simply hovers at that revenue level, unable to unlock the next phase of expansion.

The fundamental problem is one of throughput: the founder, as the sole “closer,” becomes the narrow neck through which all revenue flows. No matter how vibrant the market demand or how excellent the service delivery, the business can only book as much revenue as one person can close. That becomes the upper bound on growth. As a sales advisory firm observed, this model “works until it doesn’t” – it’s inherently unscalable past a point . When the founder’s calendar can’t accommodate more prospect calls and the personal network has been fully tapped, the sales pipeline begins to dry up.

Ironically, founders often don’t initially blame themselves – they might attribute slowing growth to market conditions or increased competition. But more often than not, the bottleneck is internal. As one startup CEO coach quips, “The founder is the bottleneck 90% of the time. Not the market, not the team – you.” . This stark realization is actually empowering: it means the company’s fate isn’t sealed by external factors, but it also underscores that continued growth will require the founder to get out of their own way.

Quantifying the Bottleneck: Opportunity Cost and Lost Growth

It’s hard to overstate how much a founder-only sales approach can hold a company back. The costs manifest in multiple dimensions – missed revenue, inefficiencies, and even human capital issues like burnout. Here we break down the impact with data and examples:

- Missed Revenue (Opportunity Cost): Every deal that doesn’t close because the founder is at capacity represents revenue left on the table. This accumulates quickly. For instance, consider a scenario documented in a SaaS sales analysis: a founder-CEO was spending so much time on a handful of small deals that he neglected larger partnership opportunities. By staying in the sales seat, he was “leaving $60K+ in growth on the table every quarter” . That’s nearly a quarter-million dollars a year of potential ARR that evaporates due to the bottleneck. In practical terms, each month without added sales capacity burns valuable bookings. Even a single mid-sized client win (say, $50K/year contract value) foregone each month sums to $600K in annual revenue loss. Over a couple of years, the cumulative opportunity cost of not scaling the sales function easily reaches seven figures in unrealized revenue. This is revenue that could have been fueling hiring, R&D, or marketing – instead it’s left on the shelf.

- Pipeline “Leakage” and Deal Slippage: Founder-led firms often experience a subtle, chronic leak in their sales funnel. Because the founder can only juggle so many prospects, response times lengthen and lesser-ready leads are ignored. A LinkedIn survey of B2B startups noted many were “losing nearly half of their pipeline to fallout” as leads slipped away without proper follow-up . In a small agency context, Louie Bernstein (a founder-turned-consultant) recounted how as his business grew, he saw classic warning signs: “Follow-ups feel overwhelming. You’re missing opportunities because you lack time to stay consistent with following up.” . In effect, the sales bottleneck isn’t just about deals not initiated; it’s also about deals in play that aren’t seen through. The latter can be even costlier, since marketing dollars or referral goodwill spent to acquire those leads are wasted. The bottlenecked founder becomes a bottleneck for conversion, not just lead generation. Over time, this drives up the “revenue leakage” – money that could have been earned if only more hours or hands were available to capture it.

- Efficiency and Sales Productivity Decline: Another measurable impact is on sales efficiency metrics. One Inc. study noted that as companies approach the ~$5M revenue mark, their sales efficiency often declines if the leadership team doesn’t evolve . In a founder-only sales environment, you might see rising customer acquisition cost (CAC) or longer sales cycles because the founder is stretched thin. Every deal takes longer to close when one person is handling too much. The founder might also start to cherry-pick easier wins (due to limited bandwidth), foregoing more complex sales that could be larger in value. This can show up in metrics as stagnation of average deal size or a lower win rate on high-value prospects. Essentially, the sales bottleneck can lead to suboptimal sales behavior – focusing on the familiar or quick wins – which in turn caps the upside. A seasoned VC, David Skok, observed that good startups sometimes miss their targets simply because “they didn’t have enough quota-carrying sales reps to make their number” . In a founder-only setup, the “number of reps” is one – and if that one is overloaded, the company will by definition miss its optimal sales output.

- Founder Fatigue and Burnout: Beyond the dollars, the human cost is significant. Founders who carry the sales burden year after year report mounting fatigue. There’s the day-to-day stress of chasing quotas and the emotional rollercoaster of wins and losses – layered on top of running the entire business. Surveys indicate that 72% of entrepreneurs struggle with mental health issues, and burnout is frequently cited as a major factor . Being the sole rainmaker contributes heavily to this burnout: it creates an “always on” pressure where the founder feels they can never step back or the revenue engine will stall . Moreover, spending 20+ hours a week on sales calls means evening and weekend hours shift to catch up on CEO duties, eroding any semblance of work-life balance. Over time, this can lead to poor decision-making, irritability with staff, and ultimately the risk that the founder becomes unable or unwilling to continue in the role. In practical terms, a burned-out founder often is the biggest risk to a young company’s continuity. Thus, the sales bottleneck problem, if unresolved, can spiral into a leadership crisis. As the founder of one tech firm lamented after the fact, “I made this mistake as a Founder, and it cost me a lot of money” – he waited too long to get sales help and paid both in growth and personal well-being .

- Delayed Discovery of Structural Issues: A more hidden consequence of the founder-led sales bottleneck is that it delays the company’s learning about its next constraints. For example, perhaps the firm’s project delivery process would start breaking at 2× the current volume of clients – maybe quality would slip or hiring would need to accelerate. But because sales never quite pushes to that volume, those delivery challenges remain hypothetical. This “shadow cost” is that the company isn’t proactively improving in areas that will matter at the next stage. It’s coasting in a comfort zone defined by the founder’s selling capacity. As one growth advisor put it, firms often don’t know what they don’t know: “if you don’t fix sales, you won’t get big enough to discover what your next constraint is.” In other words, the business’s evolution is arrested at the sales bottleneck stage, and valuable time is lost in addressing operational or strategic improvements that would be necessary for scaling. When the day comes to tackle those, the company may find itself years behind where it could have been.

To summarize the numbers: A founder-led firm plateaued at ~$3M could easily be, say, a $5M firm if it weren’t bottlenecked – meaning perhaps $2M in annual revenue is being missed due to insufficient sales capacity. That figure dwarfs the cost of bringing on a sales team or enabling a scalable sales process. Yet the drag persists, often because founders don’t quantify this gap. When they do, it becomes clear that the status quo of founder-only sales is extremely “expensive” in opportunity cost. As the Instant Hires analysis concluded, once you factor in the lost revenue, the fatigue, and slower product development that results, “it becomes clear: founder-led sales, past a certain point, is a liability.” It’s not just a minor growing pain – it is the primary barrier to the company’s success at the next level.

Evidence from the Field: Growth Plateaus in Founder-Led Firms

Numerous real-world examples illustrate how the founder-led sales bottleneck plays out in practice. These cases, from small agencies to tech startups, provide concrete evidence of the phenomenon and reinforce its ubiquity in the $1M–$5M revenue band:

- Agency Stuck at $3M Until Sales Changed: Consider a boutique marketing agency that had grown to around $3M in annual revenue with the founder as the only “closer” for new clients. For a while, things ran smoothly – the founder’s industry contacts and reputation brought in enough business. But then growth stalled. The agency hovered just above $3M for multiple years. The founder was maxed out, traveling to conferences to drum up leads and then personally pitching and negotiating every deal. Meanwhile, the delivery team often had idle gaps waiting for new projects. It wasn’t until the agency owner hired a VP of Sales and two account executives that revenue broke past the plateau. In the year following that change, the agency surged to $5M+ as the new sales team could simultaneously pursue dozens of prospects – something one person could never do. This story mirrors many others: only after delegating sales did the company “unlock” its next growth spurt (and, tellingly, start encountering the next bottlenecks, like needing more project managers – issues they welcomed because it meant they were growing again).

- Referral-Driven Startup Hits the Wall: A SaaS startup founder recounted on LinkedIn how his company grew to about $1M ARR largely via word-of-mouth and referrals – in other words, inbound sales that he (the founder) closed with minimal outbound effort. For a time, “80% of their pipeline was from word-of-mouth. Growth was ‘easy’.” But then one quarter, referrals began to dry up . The founder didn’t have other lead channels in motion and was still the only salesperson. Revenue stalled and panic set in as the pipeline went almost empty. This is a classic referral plateau. The founder noted, “referrals are incredible, but they alone won’t fuel sustainable growth. And when they dry up, most agencies aren’t prepared.” His key learning was that relying on the founder’s network (and happy clients to refer new ones) hit a natural limit. The solution – which he implemented only after stagnating – was to diversify the sales engine: they started outbound campaigns, built partner channels, and hired a salesperson. This diversified approach took the company from the plateau to multiple millions in revenue, but valuable time was lost at the plateau because the founder had not anticipated the bottleneck. It’s a cautionary tale: by the time you feel the plateau, you’re already behind in addressing it.

- Consulting Firm’s First “Roof” at $5M: Research by a consulting industry advisor found that “the first [growth plateau] frequently happens around the $5 million mark. Leads take a dip. The pipeline turns into a drip. Targets are missed, but your once-successful strategy hasn’t changed much.” In professional services, founders often rely on personal selling and a small number of large client relationships to get to ~$5M. That gets them through the “lifestyle business” phase, but going beyond requires new sales muscle. As the report notes, “the relational selling and referrals that brought your firm to the first tier of growth eventually max out.” This is exactly the founder-sales ceiling in action. For the firm in question, breaking through the $5M ceiling to reach toward $10M meant refining their go-to-market process and building a real sales function (the very things they hadn’t needed in the first leg of growth). Many larger companies that have grown past this point can usually point to a moment when they transitioned from an informal, founder-centered sales approach to a repeatable, team-based approach. Those that fail to make that transition often plateau and remain small or stagnant, sometimes for years.

- Tech Startup Board Intervention: In venture-backed startups, boards sometimes force the issue when they see the founder-led sales bottleneck. An example comes from an enterprise SaaS startup that reached about $4M ARR with the founder as the de facto head of sales. Growth then stalled for two consecutive quarters. In a board meeting, the data made it clear: sales productivity per lead was fine, but lead volume was flat because the founder had no more bandwidth to chase new deals. The investors pushed for hiring a seasoned VP of Sales. According to a sales talent expert recounting the story, “there’s usually a moment during a leadership meeting where the numbers tell the story… it’s clear something has to change.” In this case, the founder was initially resistant (“nobody can sell it like I can” is a common myth ), but he eventually agreed. The new VP built a team, and although there was a short-term dip as they ramped up, the company soon started growing again – 50% year-over-year after having been flat. This illustrates that even for high-growth startups, founder-led sales hits a wall that requires an organizational change. It’s not a matter of if, but when, provided the market opportunity is there.

These examples reinforce a consistent narrative: the founder-led sales approach is a victim of its own success. It can take a company only so far. Founders often ride it enthusiastically to that first million or few million in revenue, at which point the wheels begin to wobble. Growth slows, not because customers aren’t interested, but because the approach can’t scale further. The “hustle” that was an asset becomes a drawback, as hustle alone can’t multiply. In each case, the eventual solution was to build beyond the founder – whether by hiring salespeople, systematizing lead generation, or otherwise creating a sales engine that didn’t rely solely on the founder’s direct involvement.

It’s worth noting that larger companies have analogous issues (e.g. a single superstar salesperson or a key account manager whose limits become the firm’s limits), but those companies usually have more redundancy to compensate. In a small business, the founder is often the single point of failure. When they hit their capacity, the business hits its capacity. As one fractional executive put it, the difference between companies that break through and those that stall is often recognizing this early: the ones that scale “build a culture of non-reliance on [the founder]. Empower your team… don’t be the bottleneck in your own business.” . Those that don’t make that shift remain smaller than they need to be.

Why the Sales Bottleneck Hides Other Constraints

One of the most insidious aspects of a founder-led sales stall is how it can give a false sense of security about other parts of the business. If sales is throttled at (say) $3M, the company never grows beyond that point – and thus never fully tests its operational limits at a higher scale. This creates a kind of illusion: everything outside of sales seems under control (in fact, delivery may even feel easy, because the team is never over-stretched by a flood of new business). The founder might think, “We’re not growing, but at least our service delivery and operations are running smoothly.” In reality, those functions are running below their potential capacity, operating in a comfort zone artificially imposed by the sales constraint.

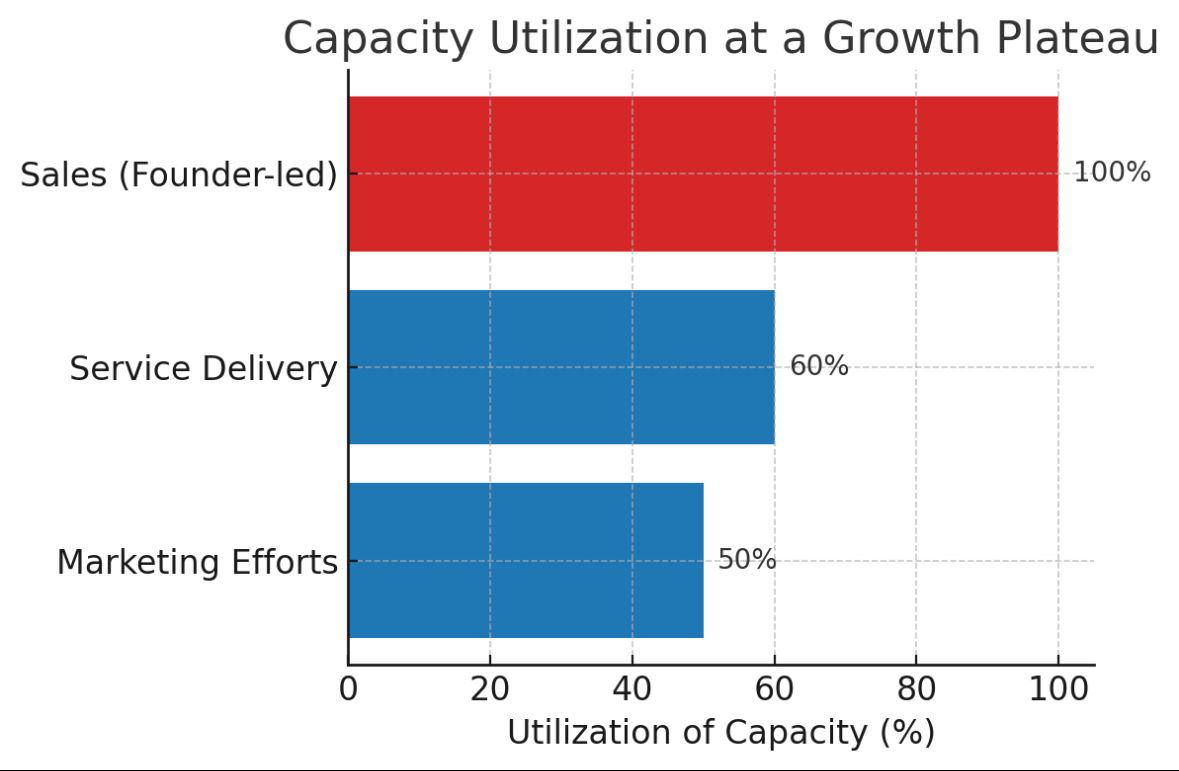

Figure 1: Illustrative capacity utilization at a growth plateau. At ~$3M revenue (founder-led stage), the sales function (red) is fully saturated (100% utilized), whereas other functions (blue) like service delivery and marketing operate well below full capacity (e.g. 50–60% utilized). The founder’s limited sales bandwidth is the narrow bottleneck that constrains overall throughput. As a result, the company never “pressurizes” its delivery, operations, or marketing to their true limits – those areas have spare capacity that is not being used because the bottleneck chokes the flow of new business.

Figure 1: Illustrative capacity utilization at a growth plateau. At ~$3M revenue (founder-led stage), the sales function (red) is fully saturated (100% utilized), whereas other functions (blue) like service delivery and marketing operate well below full capacity (e.g. 50–60% utilized). The founder’s limited sales bandwidth is the narrow bottleneck that constrains overall throughput. As a result, the company never “pressurizes” its delivery, operations, or marketing to their true limits – those areas have spare capacity that is not being used because the bottleneck chokes the flow of new business.

This phenomenon can be understood through the Theory of Constraints, a management concept that states a system’s output is determined by its tightest constraint. Here, sales (founder bandwidth) is the tightest constraint. Until that is alleviated, adding strength or capacity elsewhere doesn’t translate to growth – just like adding more lanes to a highway won’t improve traffic flow if one critical bridge is down to a single lane. In our context, a company could hire more engineers, invest in marketing, or streamline operations, but none of that yields growth while the sales bottleneck remains. The extra marketing might generate more leads, but without sales bandwidth, those leads languish. Better operations could handle more clients, but without more clients coming in, that efficiency isn’t utilized.

An important implication is that other potential constraints remain dormant. For example, a common next-layer constraint for agencies is delivery quality or client churn when scaling from 10 to 20 clients. However, if the firm is stuck at 10 clients because the founder can’t onboard more, it never encounters the churn issue – yet. This can lull founders into thinking “everything else is fine; if only we had more sales, we’d instantly scale.” In truth, when the sales constraint is removed, those other issues will surface, and likely all at once as growth resumes. But by then the organization might be unprepared, having under-invested in those areas while growth was stagnant.

This is why savvy investors and advisors often emphasize tackling the primary bottleneck (sales) early: it forces the company to confront the next constraints in line. A cascading series of constraints is a healthy sign of growth – you solve sales, then perhaps you hit a delivery capacity issue, then you solve that by hiring or process improvement, then maybe marketing becomes the constraint, and so on. If you never remove the first constraint, you never progress down this chain of improvements. One founder coach framed it aptly: “If you don’t check [being the bottleneck] in time, it may be the way that you as the leader are the ultimate limiting factor on the business itself.” . In essence, the founder bottleneck can freeze the company in an early stage of its lifecycle, never allowing it to mature operationally.

Another way the sales bottleneck hides constraints is through lack of data at scale. Many scaling challenges (e.g., whether your customer support can handle 100 tickets a day, or whether your onboarding process can handle 5 new clients a month) only become apparent with larger volumes. If sales caps volume, you don’t get the data to identify these weaknesses. So the company might assume all is well – until growth kicks in and, suddenly, things break. In consulting terms, the organization hasn’t “earned the right” to tackle those scaling challenges because it hasn’t grown enough to expose them. All attention remains fixated on the one visible issue (sales), which ironically is what needs to be solved to reveal the next issues.

Founders who eventually break past the sales bottleneck often look back and realize they had multiple unaddressed limitations waiting in the wings. For instance, after hiring a sales team, an agency might find that their project management process buckles under a 50% increase in clients – something they hadn’t dealt with during the plateau because it never arose. The smart move is to anticipate this: while working on the sales bottleneck, also prepare for the aftermath (e.g. ensure delivery processes are documented, start building middle management, etc.). Unfortunately, many don’t, because a stalled company often doesn’t have the mindset or resources to invest in “future” problems. As a result, the sales bottleneck keeps the business in a kind of stasis, where neither the pains nor the gains of scaling are felt.

In summary, the founder-sales bottleneck not only limits growth directly, but also obscures the true picture of what the business needs to scale successfully. It’s like an athlete who never pushes past a light jog – they might feel fine, but they’ll never know that at a sprint they need better endurance training. The business similarly doesn’t “stress test” its broader systems until sales throughput increases. This reinforces why breaking the sales bottleneck is so critical: it’s the gateway to experiencing and solving the next growth challenges. As long as the founder remains the sole closer, the company is effectively running on one engine cylinder while the other cylinders idle.

Visualizing the Inflection Point: Bottleneck Removal as a Catalyst

It is useful to visualize how removing the founder-led sales bottleneck can change a company’s growth trajectory. Below is a conceptual graph comparing two scenarios over a five-year span: one where a business remains founder-only in sales, and one where it transitions to a scalable sales team or process around year 3.

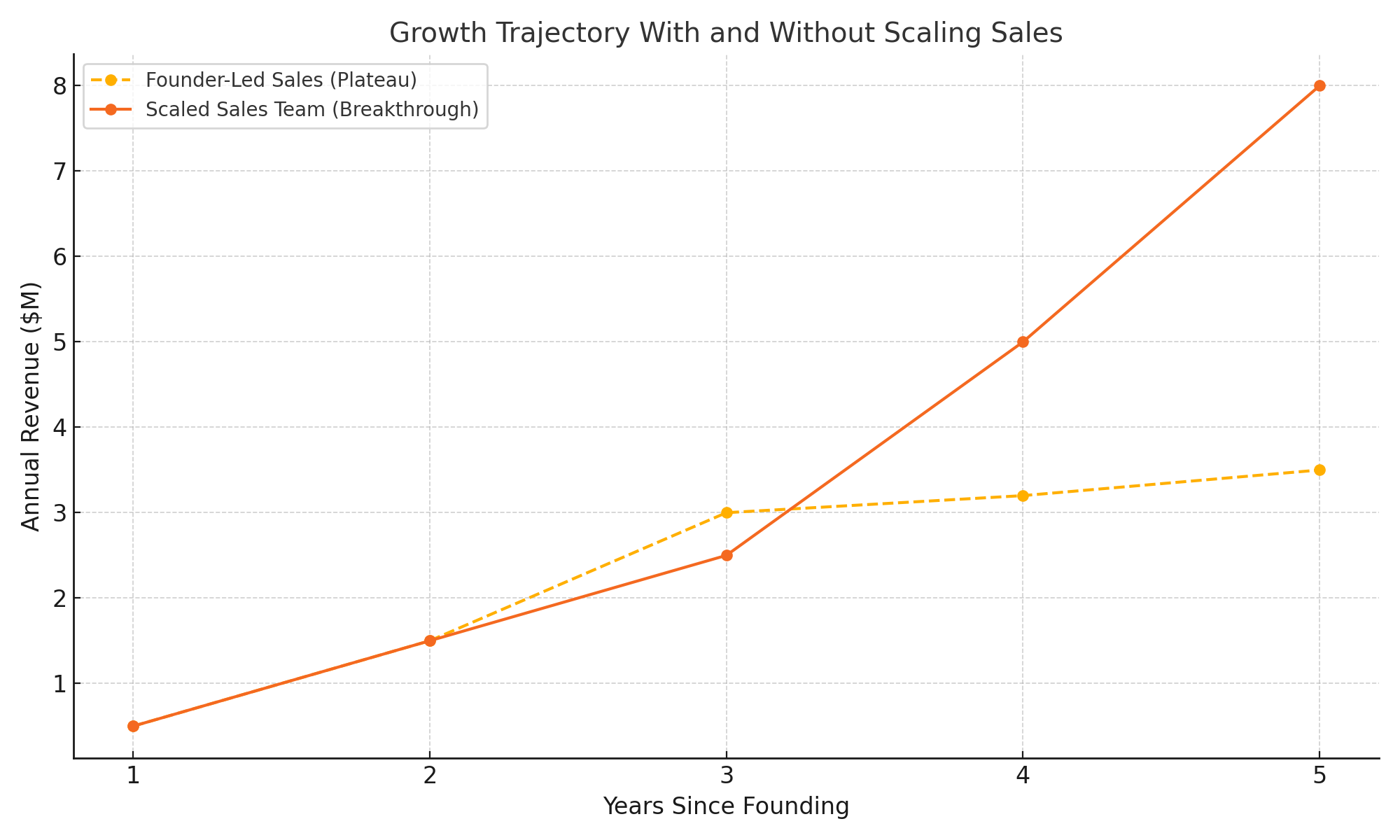

Figure 2: Growth trajectory with and without scaling the sales function. The yellow line represents a founder-led sales model that plateaus around the third year (stagnating in the low-single-digit millions of revenue). The orange line shows a scenario where the founder successfully delegates and scales the sales engine (e.g., hiring account executives, building a repeatable sales process) after year 2–3. This yields a second growth spurt – revenue climbs to $5M and $8M in subsequent years, levels that the founder-alone model could never reach. Many companies in the $1–5M range are essentially tracing the yellow line; their growth flattens because the founder’s capacity is maxed out. By contrast, adopting a team-based sales approach often enables a renewed growth curve (orange line), breaking the plateau.

Figure 2: Growth trajectory with and without scaling the sales function. The yellow line represents a founder-led sales model that plateaus around the third year (stagnating in the low-single-digit millions of revenue). The orange line shows a scenario where the founder successfully delegates and scales the sales engine (e.g., hiring account executives, building a repeatable sales process) after year 2–3. This yields a second growth spurt – revenue climbs to $5M and $8M in subsequent years, levels that the founder-alone model could never reach. Many companies in the $1–5M range are essentially tracing the yellow line; their growth flattens because the founder’s capacity is maxed out. By contrast, adopting a team-based sales approach often enables a renewed growth curve (orange line), breaking the plateau.

This visualization underscores a key point: there is an inflection point where the nature of the sales operation determines future growth. In the early years (left side of the chart), both scenarios grow similarly – reflecting how founder-driven sales can indeed hustle the company to a certain scale. But then a divergence occurs. If the company does not expand its sales capability beyond the founder (yellow line), it hits a near-flat trajectory. If it does make that leap (orange line), growth continues upward (often after a brief adjustment period). The gap between the two lines represents the foregone growth due to the bottleneck. Over time, this gap widens dramatically. In the illustration by year 5, one company is at ~$3.5M, the other at ~$8M – more than double the revenue, purely because of differences in the sales model.

Importantly, the orange “scaled sales” trajectory also means the company will have started to confront new issues: perhaps by year 5, the orange-line company is dealing with scaling customer success or entering new markets – challenges of a larger enterprise. The yellow-line company, meanwhile, might still be dealing with the same issues it had at year 3, never having grown enough to face those next-level challenges. The bottleneck hierarchy concept is evident: until you solve the top constraint (sales), you can’t even get to the point of testing the next ones. Companies that push through the founder-sales ceiling get to discover what comes after – whether it’s operational strain, market saturation, culture scaling, etc. Companies that don’t, remain in a kind of status quo equilibrium, often with the founder overworked and the organization underoptimized.

This chart is not just hypothetical. Many founders can recall the year or quarter where their paths diverged – either they broke the ceiling or they didn’t. For those who did, the experience often felt like a “leap of faith” to relinquish control over sales, followed by relief as growth resumed. For those who didn’t, the stagnation can be protracted. Some end up pivoting or downsizing, essentially giving up on scaling. Others maintain the plateau as a lifestyle business, which can be a valid choice but often wasn’t the original goal. Understanding this inflection is crucial for any founder aiming to scale: the business must outgrow the founder’s own selling capacity, or it will not outgrow the founder, period.

Conclusion

In the landscape of small and mid-size businesses, especially founder-led agencies and B2B service firms, the most critical growth limiter is often not external competition or delivery capability – it is the internal bottleneck of founder-led sales. We’ve seen how companies commonly stall around the $1M–$5M range when the founder remains the primary (or sole) deal-closer. This stall is predictable, data-backed, and rooted in simple arithmetic: one person can only do so much. The founder’s unique ability to win early business becomes the organization’s inability to win enough business to keep growing.

By analyzing this problem in depth, we validate that founder-dependent sales is the primary constraint holding these companies back from their next stage. It directly caps revenue (as shown by plateaus at ~$3M), it creates a domino effect of missed opportunities and inefficiencies (as evidenced by flatlining pipelines and growing opportunity costs), and it conceals other constraints that lie in wait. Other areas – be it operations, marketing, or product – may have their own shortcomings, but those rarely become pressing at the plateau because the company isn’t growing fast enough to expose them. The sales bottleneck is the gatekeeper issue.

Recognizing this reality is the first step. The stark truth, as one advisor put it, is that “sales is the dominant bottleneck for most bootstrapped agencies at the $1–5M mark.” Everything else – hiring, processes, even product improvements – will have diminished returns until the front-end growth engine is freed from the chokehold of sole reliance on the founder. In practical terms, this means the founder must eventually hand over the reins of sales to a scalable system (whether that’s a team, partnerships, or another repeatable model). That transition is often emotionally challenging – it strikes at the heart of the founder’s identity in the business – but the analysis in this report underscores that it is business-critical.

By focusing entirely on diagnosing the problem here, we shine a light on why this bottleneck deserves urgent attention. The cost of inaction is evident in the numbers (lost revenue, lost years of growth, and founder burnout metrics) and in the stories of peers who hit the wall. On the flip side, the companies that broke through illustrate the prize: once the bottleneck is removed, growth can resume and even accelerate, revealing a path to scaling that was previously blocked.

In closing, the founder-led sales plateau is both a common hurdle and a profound opportunity. It is common in that countless businesses face it around the same size; it is an opportunity in that overcoming it often unlocks outsized gains. For bootstrapped, founder-led firms dreaming of scaling up, the message is clear: the first and biggest growth battle to win is the one within – removing oneself as the bottleneck. Only then can the business truly discover how far it can go. The evidence and analysis presented leave little doubt that until sales is no longer solely founder-dependent, all other growth bets are off.

Sources:

- Kuramoto, R. (2025). When to Transition from Founder-Led Sales to a Scalable Sales Team – Signs that founder-led sales becomes a growth ceiling (revenue plateaus, poor lead follow-up).

- Instant Hires (2023). The Founder-Led Sales Trap – Discussion of founders spending 80% time on sales, becoming bottlenecks; quantification of opportunity cost (~$60K/Q lost by staying in sales role).

- Bernstein, L. (2023). LinkedIn post – “5 warning signs you’ve waited too long to hire your first salesperson” (stale leads, flatlining revenue, overwhelming follow-ups).

- Startup Snapshot Report via BetaBoom (2023) – Survey finding 72% of founders report burnout/mental health impact, highlighting strain on founders juggling roles including sales.

- Wasif Kasim (2023). LinkedIn post – Noting agencies relying on referrals plateau ~ $1M ARR; example of 80% referral pipeline slowing and revenue flatlining, until diversifying sales.

- Rattleback Consulting Report (Jason Mlicki, 2023) – Observing first growth plateau ~ $5M for consulting firms; explains that initial referral-based growth eventually maxes out, requiring new sales strategy to reach next tier.

- McKinsey/Shift Advisory (2025) – Implication that companies “stall at $3M… and those that sail past $10M” have invested in revenue operations (i.e., they overcame the initial sales/process bottleneck).

- Chief Outsiders (2022) – Notes that founder-led sales model becomes unsustainable as a company scales and must transition to a structured sales team to continue growth.

- Penner, J. (2019). Are You a Bottleneck? (Medium) – Using Theory of Constraints to explain how a CEO/founder acting as bottleneck limits the entire organization’s throughput.

- Entrepreneur Magazine (Cullen, 2023) – Advice from founders who scaled: “Don’t be the bottleneck… build a culture of non-reliance on you,” underscoring the need to empower a team for sales and beyond.